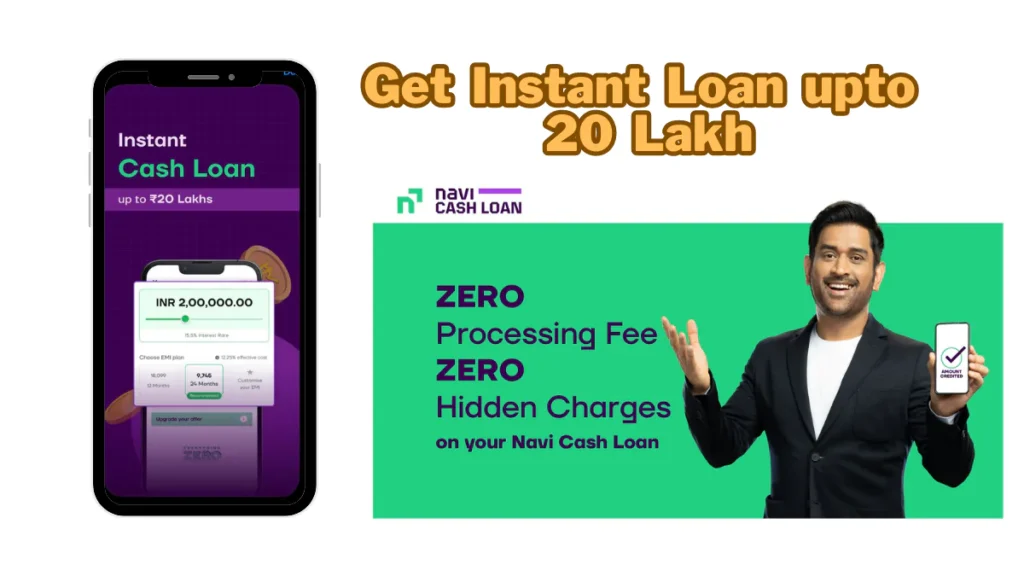

Navi App Loan 2024: How to get instant loan from Navi mobile app, know the complete process here

In today’s article, we give you very popular apps for personal loan through mobile application. -What are the steps, which are the documentary revival, along with how the loan is paid, in how many days the loan is available, you will be given information about it in this article, so you people should read this article carefully. Will read till the end.

Through any mobile application, you can get a personal loan up to Rs 5 lakh without any chips sitting at home. Let us tell you how many models are there and the most reliable is the day loan app, through which many people are doing their work by taking loans. The innovative 100% paper provides instant personal loans with minimum documentation in a hassle-free manner. Download the Navi App from Play Store or App Store, apply and get your preferred loan amount in minutes.

Managing financial relationships is important in modern life and it is also necessary to use technological tools based on it. Navi, one of the new fintech companies coming into the Indian market, is an app that suggests people to get loans easily and fast.

Key Features of Navi:

Secure and Quick Process: The key feature of Navi application is its secure and quick process. You can easily apply for the loan by uploading your required information and required documents.

Online KYC Process: Navi application has simplified the KYC process, making it easier for users to authenticate their identity.

Freedom to choose: Navi application provides freedom to the users in selecting the loan amount and tenure as per their requirements.

Fast Approval: It only takes a few hours to get your loan approved in the Navi app. This gives users confidence and can meet their financial needs quickly.

Helping in taking the right decision: Navi application helps the users in taking proper and careful decisions. You can understand and consider the terms and conditions of the loan.

How to take loan from Navi application:

Download the app: You need to download the “Navi” app from your smartphone’s app store.

Create an account: Open the app and create an account. In this you will have to provide basic information like your name, address, phone number, and email ID.

Complete the KYC process: In the application you will have to upload some documents for your KYC process.

Check Loan Eligibility: As per the directory of the app, you need to check your loan eligibility.

Submit Loan Application: If you are eligible, you will need to submit the loan application.

Loan Approval: After submitting the application, Navi Applications team will verify your information and complete the loan approval process.

Loan Approval: If your loan is approved, you have to approve the loan offer.

Loan Disbursement: After sanctioning the loan, the sanctioned loan amount will be transferred to your bank account.